Maine’s Real Estate Trends: Review of 2023 and Beyond

In 2023, buying a home was a bit like hunting for your keys in the dark, doable but challenging. Basically, the limited availability of homes resulted in an increase in prices. Per Maine Association of Realtors, 13,600 homes were sold last year in Maine compared to almost 16,900 homes in 2022. In turn the median home prices in Maine rose to $360K from $335K in 2022, an increase of about 7.5%.

| 2023 | 2022 | 2021 | |

|---|---|---|---|

| Media Home Price 1 | $360K | $335K | $299K |

| Number of Homes Sold 1 | 13,622 | 16,832 | 20,401 |

| Number of Permits Issued 2 | 4,446 | 4,635 | 5,461 |

1. Maine Association of Realtors, 2. Federal Reserve

What are the reasons for lower home availability?

Reason 1: Interest Rates and Homebody Homeowners

While most people may think a higher interest rate would dissuade new homeowners from buying, the reality is that it is influencing more homeowners with a low mortgage interest rate to stay put and not look for another home. Instead of selling their homes to trade up or down to meet their current lifestyle needs, they are making do with their current home. This in turn, results in less homes available for sale.

In 2023, Upwardly toured and evaluated numerous homes in Central Maine. Anecdotally, we found that most of these homes were listed due to major life events or job relocations. We did not see many homeowners looking to trade up and out of their low mortgage rates.

Reason 2: Building Blues

The second factor contributing to the scarcity of available homes is the decline in new construction. According to Census Data, approximately 4,400 permits were issued for single-family homes in Maine, a steady decline from 5,400 permits issued in 2021. Sadly, a permit does not necessarily mean that a home will be built, just a leading indicator that it may. In addition, higher interest rate do influence whether developers can finance new home construction projects.

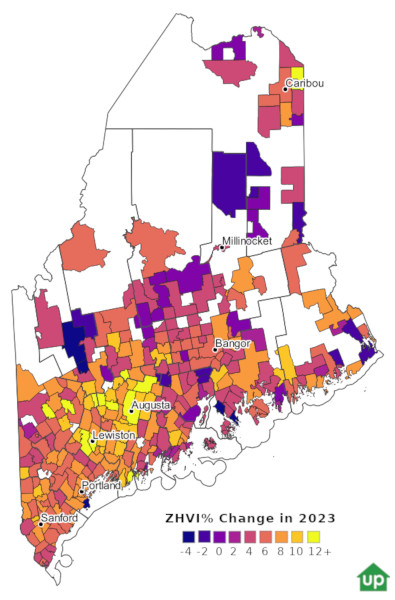

Source: Zillow Home Value Index

In diving deeper than the bigger picture perspective, Upwardly examined data from Zillow for available zip codes in Maine. The increase in home prices was not uniform. Central Maine saw a higher percentage increase in home prices, while some areas in Northern Maine had increases below the rate of inflation or actual price drops. For example, Lewiston/Auburn and Augusta saw 12%+ increase in home prices, higher than the state average of 7.5%. While parts of northern Maine, such as Franklin and Piscataquis County, lost price or grew below the 2023 annual inflation rate of 3.4%.

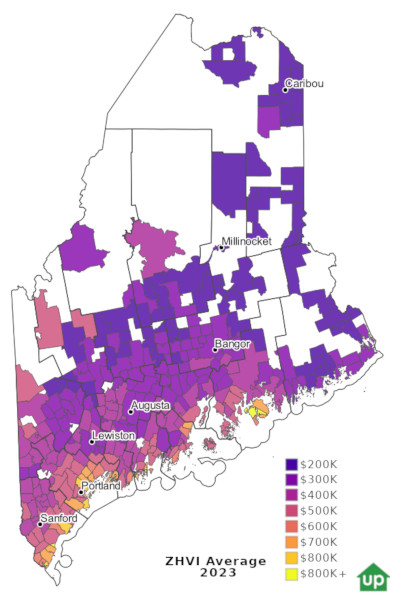

Source: Zillow Home Value Index

Concerning affordability, homes along the coast generally come with a higher price tag compared to those further inland. In the majority of Central Maine, median home prices align closely with the state median home price. It’s essential to note that while maps display home prices and changes by zip code, variations in both home prices and desirability exist within those same zip codes.

What is Outlook for 2024?

As for 2024, we anticipate that it will resemble 2023. The availability of homes is not expected to undergo significant changes in the coming months. Home prices are likely to continue their upward trajectory, matching or slightly exceeding inflation rates, owing to the persistent low availability of homes and uneven distribution across the state. If the economy continues at its current course, the Federal Reserve is projected to start lowering interest rates by the end of 2024. This potential interest rate reduction could pave the way for an increase in available homes in 2025 and 2026. However, this may not translate to lower home prices due to increase in demand for homes due to more affordable mortgages.