Demystifying Seller Financing: Things You Need to Know

There are multiple ways to finance the purchase of a home. The most common method is through a mortgage. However, not everyone qualifies for a mortgage. For example, recent college graduates with good jobs but insufficient credit history, or successful entrepreneurs without W2 pay stubs, may not qualify. People with poor credit history or insufficient funds for a down payment are also out of luck when it comes to getting a mortgage. Fortunately, there is an option called seller financing that can help those who don’t qualify for a mortgage still achieve homeownership.

What Is Seller Financing?

Instead of getting a loan from a bank or mortgage company, the buyer can choose to borrow money directly from the seller. In this case, the seller acts as the lender. Let’s consider an example: a seller is offering to sell a home for $300,000 and is willing to provide financing. The buyer needs to make a down payment of 10% ($30,000) and agree to an interest rate of 7% for a period of ten years. At the end of the ten years, the buyer must pay off the remaining amount, which is often called a balloon payment.

By opting for seller financing, the buyer can avoid involving a mortgage company and instead negotiate directly with the seller. This arrangement simplifies the loan process and allows the buyer to secure financing for the home more efficiently. Seller financing can be a useful option for individuals who may not qualify for a bank loan, as it provides an opportunity for them to buy a home.

What Are the Upsides of Seller Financing?

Seller financing allows homebuyers to avoid going through the traditional bank loan process, which means the seller’s requirements may not be as strict as those of banks. This can result in potentially lower or even no closing costs for the buyer.

- Flexible and Negotiable Terms: Almost all aspects of the financing agreement, such as the down payment amount, interest rate, payment schedule, total purchase amount, and balloon payment, can be discussed and adjusted with the seller. This provides more freedom compared to a mortgage.

- Streamlined Process: Since the seller acts as the lender, there is no need to wait for underwriting and approval from multiple individuals in a mortgage company. This can save time and make the process more efficient.

- No to Lower Closing Costs: Instead of paying a closing cost, some sellers may require a higher purchase price and/or a larger down payment. However, these terms can be negotiated with the seller, allowing the buyer to find an arrangement that works best for their situation.

It is important to note that if the seller has sold multiple homes using seller financing to buyers who intend to reside in those homes, then the seller must follow federal guidelines. These guidelines are designed to protect homebuyers and are generally more favorable to them. It is recommended to ask the seller about their experience with offering seller financing to gain a better understanding of the process and if they have done multiple seller financing deals.

What Are the Downsides of Seller Financing?

While seller financing offers advantages, it’s crucial to consider the downsides before agreeing to this type of arrangement. Many of these downsides revolve around the specific terms of seller financing.

- Higher Purchase Price: Since sellers assume more risk with seller financing, they may require a higher purchase price for the home compared to traditional financing options.

- Larger Down Payments: To mitigate the risks associated with seller financing, sellers may request a larger down payment, often around twenty percent of the home’s price.

- Higher Interest Rates and Balloon Payment: Some sellers may be open to seller financing if they can secure a better interest rate than what they would earn from other investments. However, it’s important to note that seller financing terms often include a predetermined period, such as five years, after which the remaining outstanding amount becomes due. This is commonly referred to as a balloon payment.

- Seller Default: If the seller still has a mortgage on the property, there is a risk that they could default on the mortgage. To minimize this risk, buyers should ensure that the seller fully owns the home. Alternatively, an escrow service can be set up, where the buyer pays the escrow company. The escrow company then handles the payment of the seller’s obligations, such as the mortgage, property tax, and insurance, and the seller’s portion.

Homebuyers should carefully review and understand the terms of the seller financing agreement, including interest rates, repayment schedules, and any potential risks involved. It is advisable to consult with real estate agents or attorneys for professional advice and assistance to ensure a smooth and secure transaction.

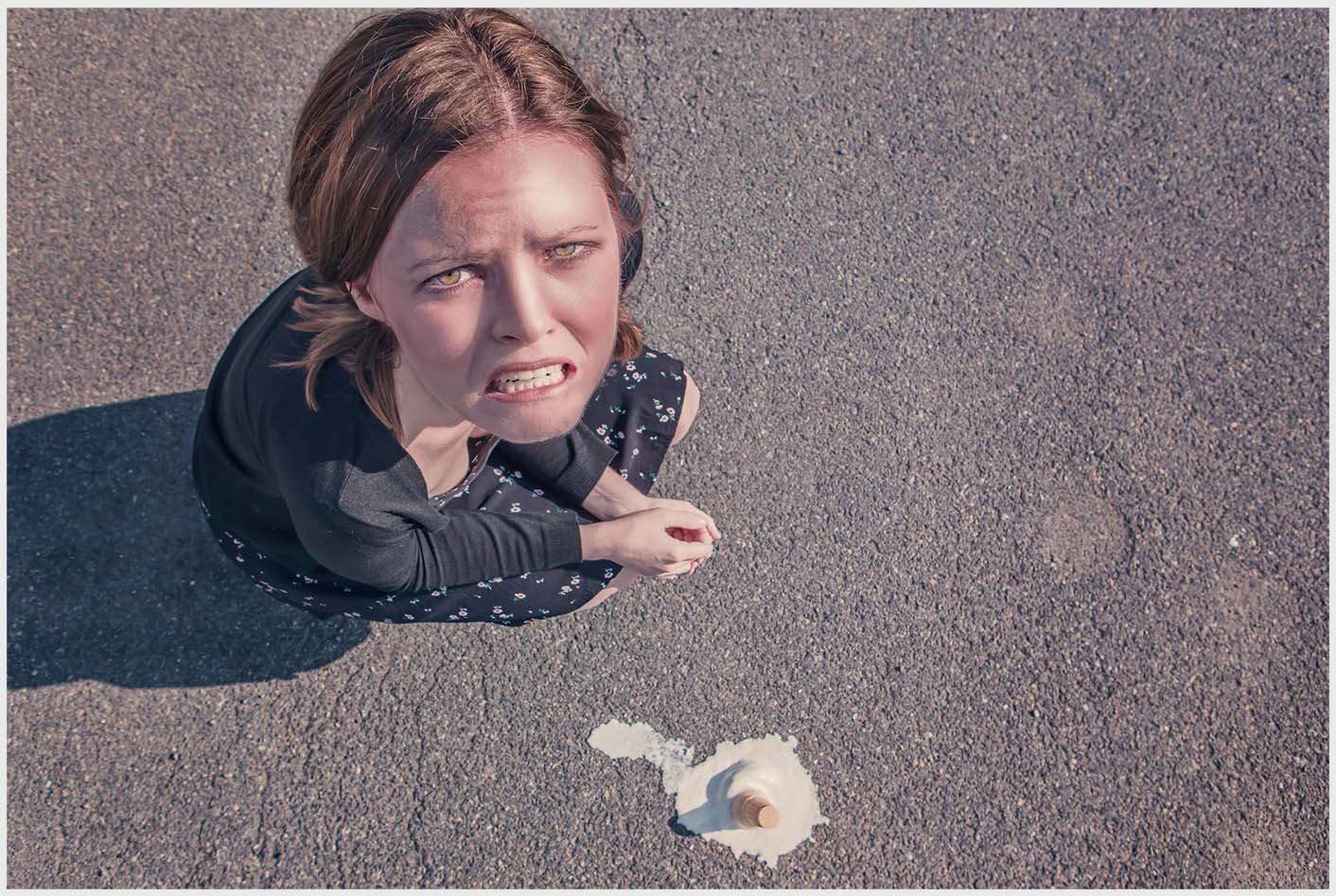

There are risks to most decisions, but greater rewards can often come with greater risks

Where to Find Seller Financed Homes?

There are fewer sellers who offer financing options compared to those who do not, resulting in a smaller number of homes available with seller financing. However, there are still places to search for homes that offer seller financing.

- Work with a real estate agent: Even with seller financing, real estate agents still earn a commission, so most agents will be interested in assisting you in finding and purchasing a home. Inform the agent that you are specifically looking for homes with seller financing.

- Check for sale by owners (FSBO): Owners who sell their properties directly may be more open to considering seller financing. You can find FSBO properties by searching on real estate websites like Zillow or Redfin, as well as platforms like Craigslist or Facebook Marketplace.

- Contact property management firms: Property management companies work with landlords and may have clients who are looking to sell their properties. Conduct a Google search for local property management companies and reach out to them to inquire about any potential seller financing opportunities.

- Ask real estate investors: Look for local real estate investor groups and inquire if any of the members are offering to sell their properties through seller financing. You can find these groups on platforms like Facebook, Reddit, Discord, Meetup, or through a simple Google search.

By exploring these avenues, you can increase your chances of finding homes for sale with seller financing. Remember to conduct thorough research and seek assistance from professionals, such as real estate agents or attorneys, to ensure a smooth and successful home-buying process.

What Are the Differences between Seller Financing and Rent-to-Own?

Another alternative path to homeownership is through rent-to-own agreements. While there are some similarities between seller financing and rent-to-own, there are also significant differences to consider. One main distinction is that seller financing involves a purchase, whereas rent-to-own is a lease with the option to purchase the home in the future. Another is availability. Rent-to-own homes may be easier to find compared to homes with seller financing. This is because there are typically more homes available for rent than for sale at any given time.

Here are some additional differences between the two approaches:

| Seller Finance | Rent to Own | |

|---|---|---|

| Key Concept | Purchase the home from the seller who is also the lender. Also known as owner finance, installment sales, or land contract. | Lease with the option to purchase the home in the future. Try out the home before buying. – Lease option – Lease purchase * * Required to purchase at the end of lease. |

| Title | Considered owner via equitable or full title. | Considered a tenant. |

| Terms | Terms are negotiable, such as down payment amount, interest, payment schedule, balloon payment, etc. | Make sure to understand if lease option or purchase, maintenance responsibility and what happens to the option credit if chose not to buy. |

| Non-Payment | Foreclosed by the lender (the seller), potential loss of equity in property. | Eviction, potential loss of option credit. |

It is crucial to carefully read and understand any agreement before signing, whether it is a seller financing agreement or a rent-to-own agreement. Since these agreements can vary among sellers and landlords, be prepared to seek legal assistance if needed and ask as many questions as possible. In addition to the financial terms, it’s important to clarify responsibilities for maintenance, property tax, insurance, and what happens in case of default or non-payment.