Buying a Home with Bad Credit Score

What is a Bad Credit Mortgage?

Home buyers with a bad credit score can still qualify for mortgages, which are referred to as bad credit mortgages. Unfortunately, bad credit mortgages are more expensive, require a larger down payment, and may have other stipulations compared to conventional mortgages.

Before diving deeper into the ins and outs of bad credit mortgages, let’s first find out what your credit score is. There are lots of free credit score services out there, such as with AnnualCreditReport.com or inquire with your bank and credit card company. Be sure to check with more than one service to get a more accurate representation of your score as different credit bureaus and services use different methodologies.

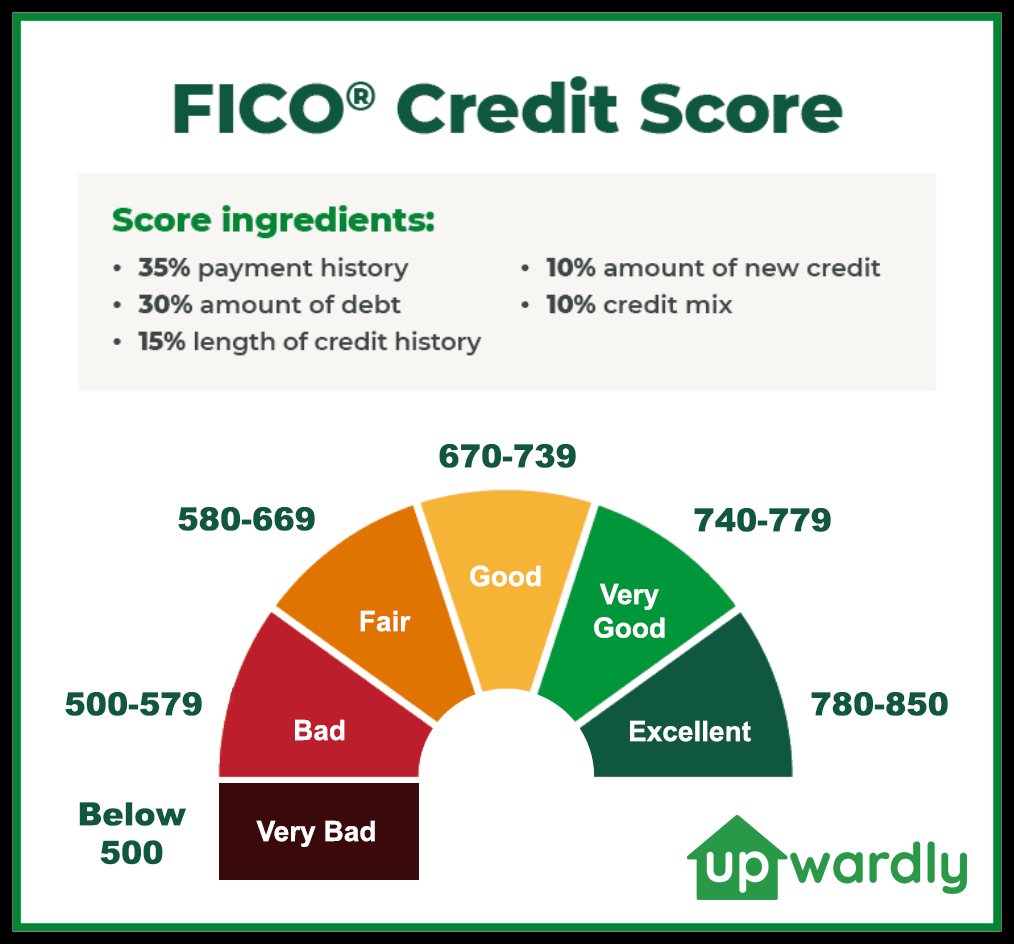

Your credit score is a numerical representation of how much risk you are to a creditor, such as a mortgage lender. The higher the credit score, the less risk you are. While, the lower the credit score, the higher risk you are. Credit score is a large factor in determining whether you qualify for a more favorable interest rate or not.

For example, a 100 point difference in credit score could translate to a 0.5% or more difference in the interest rate for a loan. The 0.5% difference is about an extra $30 per month for every $100,000 borrowed for a 30 year mortgage. It may seem small, but the $30 per month adds up over time, about $11,000 over the mortgage’s lifetime. The difference in interest rate between an excellent and bad credit score could be 1% or more.

Bad credit mortgages are typically tailored for home buyers with a credit score of 620 or less. The most popular bad credit mortgages are FHA loans. FHA loans are mortgages insured by the Federal Housing Administration. In addition, VA loans are another bad credit mortgage option that is guaranteed by the Department of Veteran Affairs. However, VA loans are available only for veterans, active military service members, and surviving spouses.

FHA Loan Requirements

| FICO Credit Score | Minimum Down Payments | Mortgage Insurance Premium |

|---|---|---|

| 580+ | 3.5% | Required |

| 500-579 | 10% | Required |

FHA loans also have the following requirements:

- Debt to income ratio less than 43%.

- Home must be the borrower’s primary residence.

- Borrowers must have steady income and proof of employment.

Furthermore, if a borrower has ever declared bankruptcy, there are additional requirements to qualify for a FHA loan, such as waiting two years after discharge and having a minimum of 580 credit score. If the credit score is less than 500, the likelihood of obtaining an FHA loan is extremely low. A good option is to improve the credit score and save for a larger down payment. Unfortunately, it may take years to do so. Another option is to look for homes with a rent to own option.

Rent to Own Homes, an Alternative to Bad Credit Mortgages

Rent to own homes provide the renter of the home with the option to buy the home at a future date. Rent to own home contracts are also referred to as lease options. Lease options typically require a fee for the right or option to buy the rented home, called the option fee. In addition, the rent for the lease option is higher than market rent for a similar home. Typically, all or a portion of the option fee and rent, referred to as rent credit, may go towards the purchase of the home. During the lease, the home buyer has time to improve their credit score to secure a more favorable mortgage by the end of the lease. Most sellers of rent to own homes are more concerned with home buyer’s ability to pay rent. Therefore, debt to income ratio is more important than credit score. Lastly, rent to own homes allow home buyers to live in the home now and try it out before committing to buying it. However, there are downsides, so beware of them before signing a rent to own contract.

Benefits of Rent to Own Homes

| Built-in Savings | A portion of the rent goes directly into a savings account (rent credit) that is retained for the eventual purchase of the property. |

| Improve Credit | Provide time for buyer to improve their credit to qualify for a better mortgage. Some landlords will report rent payments to credit agencies, which may improve the renter’s credit score. |

| Property Appreciation | Instead of constantly chasing the down payment, Rent to Own allows a renter to select a property now and share in any appreciation that happens while renting the property. |

| Pride of Home Ownership | Rent to own has the advantage of getting the buyer into the home immediately. This allows the renter to treat the property as their home and not as a rental. |

| Flexibility | Lease options give tenants the right to try out the home and purchase it later. Avoid lease purchase agreements as those require the purchase of the home at end of lease. |

Negatives of Rent to Own Homes

| Larger Monthly Payment | Since a portion of the rent goes into savings (rent credit), expect the monthly rent to be more than that of a comporable rental or mortgage. |

| Greater Maintenance | Most lease options require the tenant to take on more of a home’s maintenance than a typical rental. Understand which party is responsible for which maintenance. |

| Higher Ownership Cost | The monthly rent for lease options is usually much higher than a conventional mortgage’s monthly payment. The sooner the renter can qualify for a mortgage and purchase the home, the better they can keep ownership costs down. |

Beware of Rent to Own Scams

Unlike mortgages, rent to own homes are not widely regulated and contract terms can vary greatly from one landlord/seller to another. It is important to review the entire contract and understand the contract fully before committing to it. Treat it as if buying the home. Below are some of the main areas to understand in a lease option. A better understanding of lease options will help minimize associated risks and not get scammed.

Purchase Price. This is the price to purchase the home at the end of the lease. Beware if the purchase price is set way too low or too high, such as 20% or more above existing market value.

Monthly Rent: Check if the monthly rent is affordable. How often and how much can the seller raise the rent? Look out for any balloon payments, significantly higher rent, towards the end of the lease.

Option to Buy: Make sure it is a lease option and not a lease purchase. Lease purchase requires the purchase of the home at the end of the lease. If the home drops in value, the renter is on the hook to buy the house. Lease option gives the renter the right to buy or not. It is important to reiterate, make sure rent to own contract is a lease option and not a lease purchase. In addition, look for any conditions that govern how options are voided, such as due to eviction. For example, does late rent or missing rent automatically void the lease option or is there a reasonable amount of time to remedy late rent?

Option Fee and Rent Credit: Look out for languages that stipulate how much of the option fee and rent credit is refunded if renter decides not to buy the home. Be very cautious of any contracts that keep 100% of the option fee and rent credit, because unscrupulous sellers will stack the deck against the renter to keep all the option fee and rent credit.

Lastly, invest in a title report to make sure there are no liens on the property and the seller is the true owner. Ask for monthly mortgage and annual property tax payment receipts, so the seller is current and not at risk of foreclosure.

Where Can I Find Rent to Own Homes?

If rent to own still sounds appealing, then there are several options for finding rent to own homes.

- Upwardly: We provide an innovative approach to rent to own by co-investing in a home with the homebuyer. The home buyer finds a home that they want and Upwardly will buy it for them as a co-investment. The homebuyer rents the home, earns equity, and improves their credit score. At the end of lease, if the homebuyer decides to buy the house, we split the home’s appreciation with them.

- Listings: Upwardly is not endorsing or receiving compensation for any of the following rent to own listing services. The websites are listed for convenience and not an endorsement. These website may list for sale properties along with rent to own.

- Landlords: Inquire with current or future landlords if they offer a lease option. Not applicable for apartments.

- Real Estate Agents: They may know of possible sellers that are willing to offer lease options. Be aware that not all real estate agents are enthused about lease options as their commission is deferred until the house is purchased. However, there are real estate agents that do have experience with it and are receptive. Time and patience is required to find such an agent. Ask around.

Conclusion of Buying a Home with Bad Credit Score

Having a bad credit score does not preclude home buyers from owning a home. A bad credit score makes it more expensive and challenging to own a home. FHA loans are a great option for folks with bad credit. The downside is higher monthly payments, larger down payments, and greater total cost of ownership. Another alternative is to find rent to own homes, also referred to as lease options. Home buyers lease the home first and have the option to buy the home at the end of the lease. Home buyers with bad credit get to try out the home first and improve their credit score. However, lease options are not as highly regulated as mortgages, so review the contract carefully before signing it. Treat it like buying a home. Lastly, waiting to buy a home is always a good alternative. Focus on improving credit score and saving for a larger down payment. It can take years, but will save tens of thousands of dollars over the life of the loan.

FICO, the FICO Logo and the FICO product and service names are trademarks of Fair Isaac Corporation.